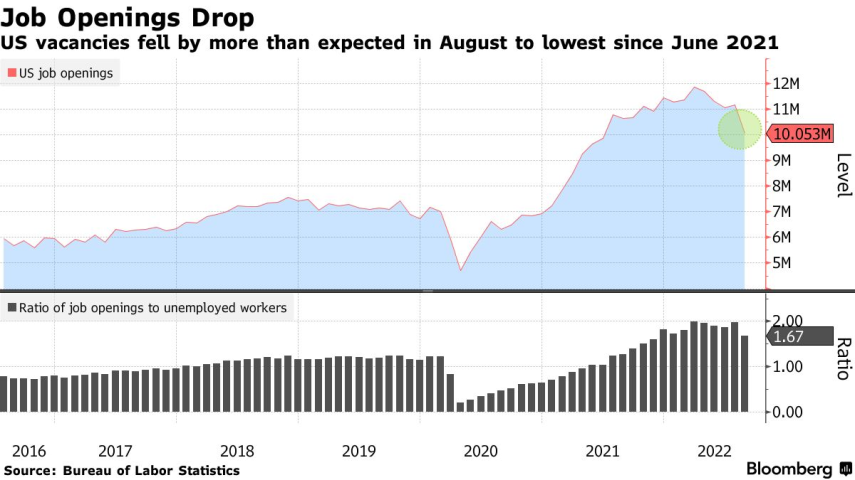

All eyes are on today’s JOLTS Job Openings report for June, as traders and policymakers alike look for clues ahead of tomorrow’s crucial Federal Reserve interest rate decision.

According to market expectations, Job Openings are forecast to decline to 7.55 million, down from 7.76 million in May. This report is one of the Fed’s key tools for assessing labor market strength — which directly impacts inflation expectations and interest rate decisions.

📊 Economic Snapshot:

Release Date: Tuesday, July 29, 2025

June Forecast: 7.55 million

May Actual: 7.76 million

Rate Cut Odds: No cuts expected this month, but a surprise reading below 7 million could increase the chances of a 25bps cut in September to over 60% (CME FedWatch Tool)

💡 What This Means for Traders:

If Job Openings come in weaker than expected, especially below 7 million, the market could interpret this as a clear sign of labor market deterioration — increasing the likelihood of Fed easing soon. This scenario would likely:

Pressure the US Dollar

Fuel bullish momentum in Gold (XAU/USD)

Support upside on US indices like US30 and NAS100

However, if the data is strong or matches forecasts, the Dollar may strengthen temporarily, while markets wait for Powell’s statement tomorrow.

✅ For Our Premium Members:

We have already prepared scenario-based trade setups based on how this JOLTS data plays out. Our VIP traders will receive:

Real-time signals

Clear risk-to-reward setups

Multiple take-profits based on momentum reaction zones

⚠️ Still Not Subscribed?

Major economic events like this move markets with sharp volatility — and only our Gold Scalping Signals Premium members get accurate, timely setups designed to capture those fast swings.

Stop missing out on:

✅ High-accuracy signals

✅ Tight risk management

✅ AI + Price Action-based analysis

🔐 Join now and start profiting today